Swing and Day Trading: The Complete Guide to Start Creating a Passive Income on Options and Swing Trading with Tips and Tricks

37.44 $

- Author: Jeremy Walters

- Skill Level: Beginner to Intermediate

- Format: PDF (Digital Download)

- Pages: 222

- Delivery: Instant Download

Swing and Day Trading by Jeremy Walters is a complete beginner-to-intermediate guide designed to help readers understand and apply two of the most popular active trading styles. Walters breaks down the mechanics of swing trading and day trading into simple, actionable steps, showing how ordinary traders can leverage these methods to build consistent profits and even create streams of passive income.

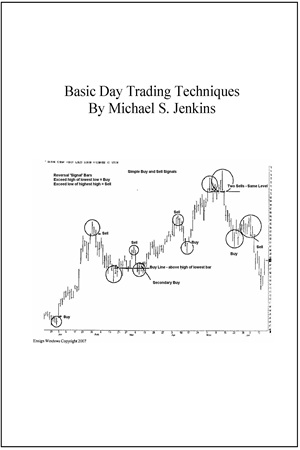

The book begins with the foundations of swing trading—what it is, how it works, and how it differs from other approaches like scalping and long-term investing. Walters emphasizes the role of price action as the central tool for market decision-making and introduces readers to practical strategies for identifying setups, executing trades, and managing positions.

Beyond strategies, the book explores the psychological side of trading—why so many traders lose money, the common pitfalls that derail beginners, and how to develop the discipline and emotional balance required for long-term success. It also covers cash and risk management techniques, candlestick analysis, chart patterns, and essential trading indicators such as Ichimoku, ADX, and Williams Alligator.

For those leaning toward day trading, Walters provides a clear roadmap: understanding instruments like stocks, futures, options, and forex, choosing the right software and brokers, and setting up platforms to trade efficiently. By combining technical insight with practical tips, Swing and Day Trading equips readers to handle the realities of financial markets while avoiding costly mistakes.

Whether you are new to trading or seeking to sharpen your edge, this guide delivers both the conceptual knowledge and the tactical playbook to thrive in today’s fast-moving markets.

✅ What You’ll Learn:

- The core principles of swing trading and how it compares with scalping and day trading.

- How to use price action as a reliable guide to market behavior.

- Key swing strategies for trading stocks, forex, and other markets.

- Trading psychology: why traders fail and how to build mental resilience.

- Practical risk management techniques for capital preservation.

- Candlestick and chart patterns every trader should recognize.

- How to use trading tools and indicators like Ichimoku, ADX, and Williams Alligator.

- Step-by-step setup for day trading platforms, brokers, and software.

- Detailed breakdown of instruments—stocks, futures, options, and forex—and how to trade them effectively.

💡 Key Benefits:

- Comprehensive coverage of both swing and day trading in a single resource.

- Simplifies complex market concepts into clear, beginner-friendly explanations.

- Balances technical strategies with trading psychology and risk control.

- Equips traders with a toolkit of patterns, strategies, and platforms to start trading immediately.

- Written in a practical, accessible style to guide traders from first steps to confident execution.

👤 Who This Book Is For:

- Beginners exploring active trading for the first time.

- Intermediate traders looking to sharpen strategies and avoid common errors.

- Investors wanting to diversify into short-term trading opportunities.

- Anyone interested in developing a disciplined, professional approach to markets.

📚 Table of Contents:

- Introduction to Swing Trading

- Swing Trading Basics: What It Is and How It Works

- Issues With Swing Trading Using Options

- Markets You Can Swing Trade

- Swing Trading – How to Trade?

- Swing Trading Stocks That Help You Earn More

- Day Trading vs Swing Trading

- Scalping vs Swing Trading

- The Most Important Thing: Price Action

- Market Psychology for Swing Trading

- Swing Trading in Forex

- Why Traders Lose Money

- Cash and Risk Management

- Specialized Analysis for Swing Trading

- Candlestick Analysis and Chart Patterns

- Swing Trading with Tools and Indicators

- Why You Should Start With Swing Trading

- Swing Trading Strategies for Beginners and Advanced

- Day Trading: Basics, Instruments, and Platforms

- Hardware, Software, and Brokers

- Understanding Day Trading Software

| Author(s) | Jeremy Walters |

|---|---|

| Format | |

| Pages | 222 |

| Published Date | 2020 |