Contrarian Ripple Trading: A Low-Risk Strategy to Profiting from Short-Term Stock Trades

35.30 $

- Authors: A.J. McNamara, M.A. Brozyna

- Skill Level: Beginner to Intermediate

- Format: PDF Ebook

- Pages: 199

- Delivery: Instant Download

Contrarian Ripple Trading introduces a unique and systematic short-term trading method that focuses on taking advantage of “ripples” in market prices rather than chasing large trends. Written by A.J. McNamara and M.A. Brozyna, the book outlines a disciplined, rules-based system for exploiting short-term overreactions in stocks, giving traders a low-risk approach to generating consistent returns.

At the heart of the Ripple system is the principle of contrarian thinking—buying when fear is excessive and selling into strength. McNamara and Brozyna show how to identify price ripples with high probability setups, apply filters to improve accuracy, and use precise entry and exit strategies. Emphasis is placed on risk control, including position sizing, stop-loss techniques, and trade management, making the method suitable for traders who prefer structured approaches.

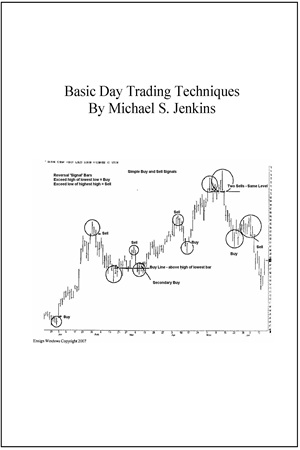

Unlike many trading systems that rely on subjective interpretation, Ripple Trading is presented as a mechanical system with clear rules. The authors provide numerous charts, historical examples, and step-by-step explanations to guide traders in applying the system in real market conditions.

Practical, disciplined, and accessible, Contrarian Ripple Trading is designed for traders who want a proven framework that balances risk and reward, avoids emotional trading, and capitalizes on predictable short-term market moves.

✅ What You’ll Learn:

- The principles of contrarian trading and market psychology

- How to identify short-term “ripples” in stock prices

- Step-by-step rules for entries, exits, and risk management

- Filters and confirmations to improve trade accuracy

- How to manage positions with discipline for consistent profits

💡 Key Benefits:

- Provides a clear, mechanical trading system with defined rules

- Focuses on short-term trades with low risk and high probability setups

- Eliminates emotional decision-making with systematic discipline

- Suitable for traders seeking consistent results without chasing trends

- Includes charts and examples for easy application

👤 Who This Book Is For:

- Traders who prefer rule-based, mechanical systems

- Short-term stock traders seeking low-risk, high-probability setups

- Investors interested in contrarian methods and psychology

- Beginners to intermediates looking for a structured trading plan

📚 Table of Contents:

- Part I – The Ripple Trading Concept

- Part II – Rules and Setups for Contrarian Ripple Trades

- Part III – Risk Management and Trade Execution

- Part IV – Testing and Applying the Ripple System

- Part V – Case Studies and Examples

- Appendices & Index

| Author(s) | Aidan J. McNamara, Martha A. Brozyna |

|---|---|

| Format | |

| Pages | 199 |

| Published Date | 2008 |