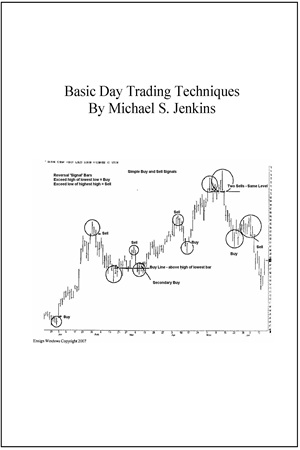

Basic Day Trading Techniques

38.89 $

- Author: Michael S. Jenkins

- Skill Level: Intermediate to Advanced

- Format: PDF eBook

- Pages: 135

- Delivery: Instant Download

Basic Day Trading Techniques is a cornerstone manual from legendary trader Michael S. Jenkins, designed to teach aspiring and professional traders how to make money every single day using timeless principles. Distilled from over 36 years of trading experience, this guide unveils the logic and techniques that separate consistent winners from those who merely gamble in the markets.

Jenkins doesn’t waste time on surface-level strategies—instead, he walks you through the essential tools, patterns, and time-based methods that institutional traders use to time entries and exits with confidence. Whether you’re trading stocks, futures, or indexes, Jenkins equips you with the chart-reading, risk management, angle analysis, and money-making mindset necessary to profit from any market condition.

You’ll also learn how to avoid the most common pitfalls, apply proven Gann and square root concepts, build a disciplined business plan, and integrate unique tools like Jenkins Natural Ratios and Time Conversion Bars into your trading arsenal.

✅What You’ll Learn:

- Core principles of trend identification and risk management

- How to build a repeatable, scalable trading strategy from the ground up

- The role of square roots, angles, and time cycles in price movements

- Pattern trading methods: overlap zones, flags, triangles, measured moves

- Execution psychology and money management systems used by pros

- Day trading business planning for consistent monthly profits

- Practical use of Jenkins’ proprietary tools: Natural Ratios & Time Conversion Bars

💡Key Benefits:

- Learn directly from one of Wall Street’s most respected intraday traders

- Convert basic chart patterns into high-probability trades

- Eliminate emotional trading through structured entry and exit rules

- Apply timeless principles that remain effective across all asset classes

- Build the mental discipline needed to scale from $500 to $10,000+ daily

👤Who This Book Is For:

This book is ideal for traders who:

- Want to become full-time or professional day traders

- Are frustrated with unreliable systems and inconsistent results

- Seek structured, repeatable trading strategies grounded in price logic

- Need to understand how time, price, and trend geometry affect trades

- Value a practical, no-nonsense approach to building trading mastery

📚Table of Contents:

- Acknowledgements

- Where To Begin

- Stops

- Measured Moves

- Square Roots In Time

- Angles

- Developing Trading Strategies

- Business Plan

- Basic Overlap Methods

- Basket Program Arbitrage

- Options

- How Do They Get Out?

- Volume

- What Goes Round Comes Round

- Gimmicks Short Time Exposure

- Pattern Trades

- Flags, Pennants, & Triangles

- Characteristics of Market Players

- Basic Time Cycles

- Putting Our Game Plan Together

- Moon Cycles

- Review of Charts: Entry and Exits

- The Jenkins Time Conversion Bar

- Recap on Basic Trading Steps

| Author(s) | Michael S. Jenkins |

|---|---|

| Pages | 135 |

| Format | |

| Published Date | 2007 |