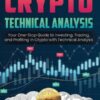

Crypto Technical Analysis: Your One-Stop Guide to Investing, Trading, and Profiting in Crypto with Technical Analysis

15.30 $

- Author: John Alan Law

- Skill Level: Beginner to Intermediate

- Format: PDF, EPUB

- Pages: 523

- Delivery: Instant download after purchase

“Crypto Technical Analysis” by John Alan Law is a complete beginner-to-intermediate guide tailored specifically to the volatile, high-potential world of cryptocurrency trading. While crypto markets may seem chaotic, this book brings clarity with tried-and-tested technical tools, empowering you to make data-driven decisions across Bitcoin, Ethereum, altcoins, and more.

Written in a clear, jargon-free style, the book explains the core building blocks of technical analysis, such as support and resistance, candlestick patterns, moving averages, RSI, MACD, Fibonacci levels, and trendlines. But what makes it especially valuable is how these tools are applied to crypto market behavior, where volatility, low liquidity, and sentiment can distort traditional signals.

You’ll also explore:

- How to set up your crypto charts for clarity and speed

- When to enter and exit trades based on price structure

- Which indicators to combine for high-probability setups

- How to use TA across short-term trading and long-term investing

- Tools and platforms tailored to crypto analysis (e.g., TradingView)

Whether you’re swing trading, scalping, or building a long-term portfolio, this guide helps you avoid emotional decisions and apply methodical, pattern-based reasoning to your trades.

✅ What You’ll Learn:

- The core principles of technical analysis and why they work in crypto

- How to read and use candlestick charts for timing

- How to identify breakouts, trends, reversals, and consolidations

- Setting stop-losses, take-profit levels, and managing capital

- Key crypto-specific strategies and patterns

- Common pitfalls in crypto trading and how to avoid them

💡 Key Benefits:

- Designed specifically for crypto traders and investors

- Applies classic TA tools to modern digital assets

- Simplifies complex indicators into practical strategies

- Helps avoid the hype and focus on objective price behavior

- Gives you the confidence to execute trades with clarity

👤 Who This Book Is For:

- Beginner and intermediate traders entering the crypto space

- Investors wanting to manage risk and improve timing

- Crypto enthusiasts looking to go beyond intuition and emotions

- Traders shifting from traditional markets to digital assets

- Anyone who wants to understand how price patterns predict crypto movement

📚 Table of Contents:

- Introduction to Crypto and Technical Analysis

- Market Structure and Psychology

- Candlestick Basics and Chart Patterns

- Indicators and Oscillators (RSI, MACD, Stochastics)

- Trendlines, Channels, and Fibonacci Tools

- Trading Platforms and Crypto Charting Tools

- Crypto-Specific Strategy Development

- Risk Management and Capital Protection

- Day Trading vs Swing Trading in Crypto

- Trading Mindset and Avoiding Common Mistakes

- Final Thoughts and Growth as a Technical Trader

| Author(s) | Alan John, Jon Law |

|---|---|

| Format | PDF, EPUB |

| Pages | 523 |

| Published Date | 2021 |