Trader Vic on Commodities: What’s Unknown, Misunderstood, and Too Good to Be True

17.38 $

- Author: Victor Sperandeo

- Skill Level: Intermediate to Advanced

- Format: PDF

- Pages: 222 pages

- Delivery: Instant Download

Unlock the Real Truths Behind Commodity Trading from a Wall Street Legend

In Trader Vic on Commodities, legendary trader Victor Sperandeo exposes the misconceptions and misinformation surrounding commodities. Drawing from his decades of experience and unfiltered Wall Street insight, Sperandeo offers an honest and practical look into what truly drives commodity markets, including crude oil, gold, agricultural futures, and more.

Far from another theory-heavy investment guide, this book is a hands-on blueprint for traders and investors who want to capitalize on the commodity sector with a clear, rational strategy. Sperandeo challenges popular myths, debunks the media hype, and presents sound trading principles grounded in economic reality.

Whether you’re an intermediate trader seeking deeper understanding or an advanced investor looking to sharpen your edge, this book is a must-have resource for mastering commodities in an unpredictable global market.

✅What You’ll Learn:

- How supply, demand, and macroeconomic trends truly affect commodity prices.

- Why the general public often misunderstands inflation’s real role in commodity valuation.

- Detailed insights into gold, oil, and other key commodity markets.

- How to develop a trading mindset focused on reality—not hype.

- Risk management techniques from one of the most disciplined traders in history.

💡Key Benefits:

- Learn from a seasoned trader who lived through multiple market booms and crashes.

- Cut through the noise and avoid the costly myths most commodity investors fall for.

- Master practical, actionable concepts that can be applied across all commodities.

- Gain strategic insights on trading psychology and capital preservation.

👤Who This Book Is For:

- Intermediate to Advanced traders and investors.

- Those interested in commodities like oil, gold, and agricultural products.

- Anyone seeking honest, experience-backed financial education.

📚Table of Contents:

- The Basics

- You Can’t Win Them All

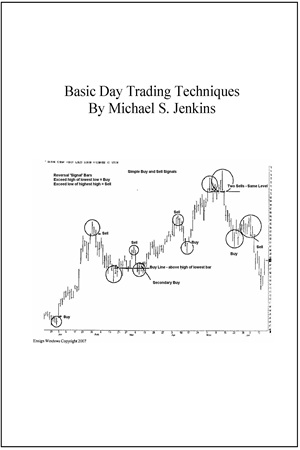

- Indicators and Tools

- 2B or Not 2B: A Classic Rule Revisited

- An Introduction to the S&P DTI

- A Challenge to the Random Walk Theory

- The Rationale and Value of a Long/Short Futures Strategy

- Why the S&P DTI Is an Indicator

- The Fundamental Reason the S&P DTI Generates Core Returns

- The Nature of the S&P DTI Returns

- A Fundamental Hedge

- S&P DTI Subindexes: The S&P Commodity Trends Indicator and the S&P Financial Trends Indicator

- Afterword

- Appendix A: S&P DTI Methodology and Implementation

- Appendix B: How to Interpret Simulated Historical Results

- Appendix C: Correlation Statistics

- About the Author

| Author(s) | Victor Sperandeo |

|---|---|

| Format | |

| Pages | 222 |

| Published Date | 2008 |